Introduction

Trade remedy measures continue to remain a bulwark for the protection of the domestic industry from unfair imports. With the government’s increasing emphasis on the ‘Make in India’ objective and the Indian economy booming, trade remedy measures retain their importance as an instrument to balance the interests of domestic producers with that of users and importers.

The year 2023 whizzed past as a busy and important year for trade remedy investigations in India. This article is intended to provide a year-end round up of the trade remedy investigations related initiations, final findings, and measures imposed by the government.

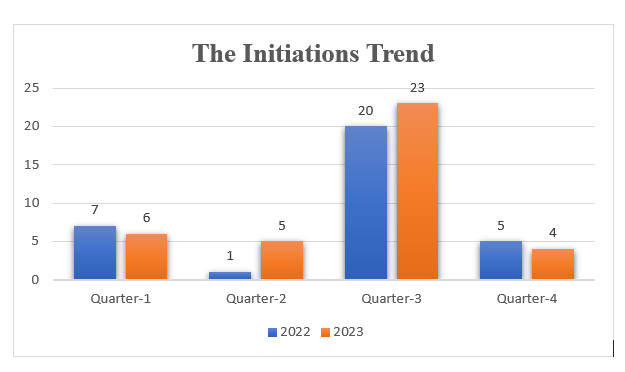

Phase-1 – Initiations

The nodal authority for trade remedy investigations in India is the Directorate General of Trade Remedies (‘DGTR’), which is the authority for initiating investigations. With a total of 38 initiations in the year 2023, the end of the third quarter (September 2023) was the busiest with a record number of 23 investigations having been initiated. The third quarter generally witnesses the maximum number of initiations, since the period of investigation for such investigations is April to March, i.e., the same as the Indian financial year. The remaining quarters were relatively lighter – with the end of March 2023 seeing 6 initiations, the end of June 2023 seeing 5 initiations, and the end of December 2023 seeing four initiations.

Most of the investigations were anti-dumping investigations, and the following pattern was observed:

1. There were 32 anti-dumping investigation initiations, out of which, 22 were original, 8 were sunset reviews, 1 was a mid-term review, and 1 was an anti-circumvention investigation.

2. There were only 5 countervailing initiations, out of which 2 were original, and 3 were sunset reviews.

3. There was also 1 safeguard (quantitative restrictions) investigation initiation.

This trend is quite similar to the 2022 initiation trend, with five more investigations initiated in 2023.

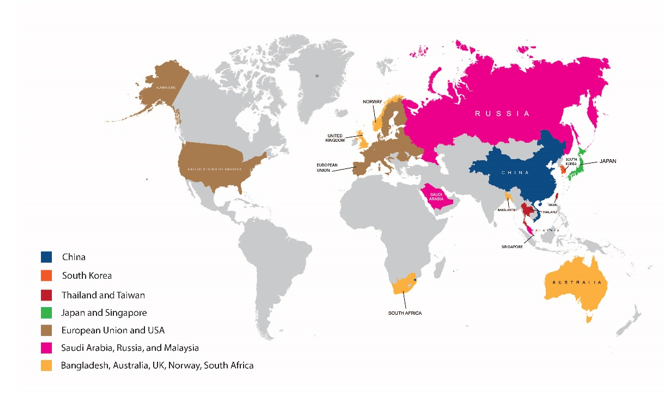

Countries targeted

Out of 38 initiations, China topped the list as a target country, followed by South Korea which was the target country in 6 initiations. The chart below highlights all the countries subjected to trade remedy investigations in 2023. The list is as follows:

1. China - 31

2. South Korea – 6

3. Thailand and Taiwan – 5 each

4. Japan and Singapore – 4 each

5. European Union and USA – 3 each 6. Saudi Arabia, Russia, and Malaysia – 2 each

7. Bangladesh, Australia, UK, Norway, South Africa, Chinese Taipei – 1 each

Another interesting aspect is that the DGTR initiated some investigations suo moto. These included the initiations against imports of Fasteners, Unframed Glass Mirror, Vacuum Insulated Flask, Telescopic Channel Drawer, and Roller Chains. The target country in all these suo moto initiations was China. This probably reflects the intention of the DGTR to assist fragmented industries in making use of the trade remedies framework.

Phase II – Recommendations

In 2023, the DGTR issued 32 final findings as against 40 final findings in 2022. It is worth noting that the DGTR recommended the imposition/continuation of duty in 30 final findings.

The two investigations (both anti-dumping) in which duty was not recommended by the Authority were on Metronidazole from China and sunset review concerning Textured Tempered Coated and Uncoated Glass from Malaysia.

Metronidazole is a rare instance where the investigation was terminated upon concluding that there was no injury and causal link. The DGTR reasoned that the domestic industry’s profitability parameters were positive throughout the injury period, except for the second half of the period of investigation. In a detailed causal link and non-attribution analysis, the DGTR concluded that the injury being faced by the domestic industry in the second half of the period of investigation was due to an increase in the prices of the raw material namely 2 Methyl 5- Nitro Imidazole. It was observed that this increase in the raw material prices coincided with the decline in the domestic industry’s profitability parameters. Hence, injury, if any, in the second half of the period of investigation was caused due to the increase in the raw material prices, and not as a result of dumped imports. The DGTR accordingly terminated the investigation due to lack of injury and causal link.

In Textured Tempered Glass, only one producer from Malaysia, Xinyi Solar, had exported the product to India during the period of investigation. The said producer was treated cooperative, and the subject imports were not considered to be dumped. Xinyi Solar had been treated cooperative in the original investigation as well and was awarded zero duty. The dumping margin for Xinyi in the sunset review was also negative.

The DGTR concluded that since Xinyi Solar was the sole producer in Malaysia, and the dumping margin was negative, it inter alia implied that the dumping margin for Malaysia as a whole was negative. Hence, continuation of duty was not recommended, and the investigation terminated.

While a major chunk of the investigations initiated in the year 2022, were concluded, two investigations initiated in 2022 on alloy steel chisel/ tool and hydraulic rock breaker in fully assembled condition from China and South Korea and Vitamin-A Palmitate from China, the EU, and Switzerland are still pending. While in Vitamin-A, the time for completion of the investigation has been extended until 28 March 2024, in Rock Breaker, no such extension notice is available on the DGTR website, which is unusual.

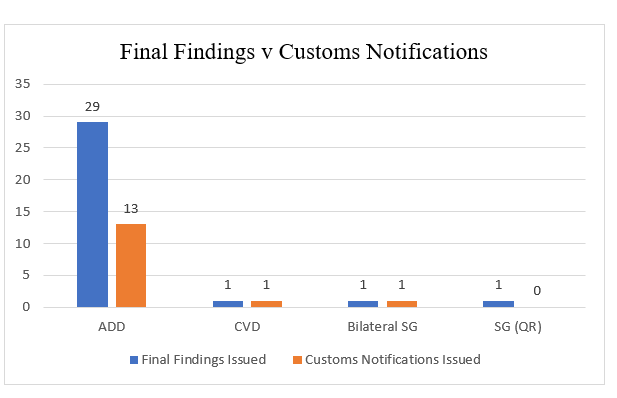

Phase-III – Implementation

In this section, we analyze the instances of acceptance of the DGTR’s positive recommendations in its final findings by the Ministry of Finance (‘MoF’). Readers may be aware that the MOF’s refusal to accept the DGTR’s recommendations in a number of cases has led to major legal and policy controversy.

In 2023, the DGTR’s recommendations to impose/continue duties were accepted by the MoF in over 15 instances. While 13 of these instances concerned original anti-dumping investigations, anti-dumping duty was continued pursuant to one sunset review. In the sole safeguard determination in the bilateral safeguard investigation concerning Ferro Molybdenum from South Korea under the India-Korea free trade agreement, the MOF accepted the DGTR’s positive recommendations. The ratio of acceptance of the final findings is as follows:

As compared to the previous year, the MoF issued more notifications in the year 2023. In the year 2022, there were 13 acceptances by the MoF, which were majorly dominated by imposition of anti-dumping duty. However, unlike 2023, the number of instances of continuation of duty pursuant to sunset reviews was quite high in 2022. The MoF imposed duty in 7 original cases and continued duty pursuant to 6 sunset reviews in 2022.

The Customs Notifications for the final findings issued in the last three months of 2023 are still awaited.

2023 – The Key Trends:

The third quarter is the busiest: In terms of both initiations and issuance of final findings, the third quarter of the year remains the most productive and the busiest quarter for the DGTR.

China on the Radar: The maximum number of investigations were initiated against imports from China, and this is a continuing trend. Investigations against China surpass investigations against other countries by a significant number. Other targets included Asian countries like South Korea, Thailand, Vietnam, and Taiwan.

Safeguard Quantitative Restrictions-The Emerging Trade Remedy: An interesting trend seen in 2023 is the initiation of safeguard investigations, which are considered to be ‘emergency actions’ against the surge of imports of a product and the measures are put in place for a period of 2 to 3 years. While the DGTR has undertaken many safeguard duty investigations in the past, it has also started considering applications to impose safeguard measures in the form of quantitative restrictions. Unlike other trade remedy measures that impose duties on the import of specific products, these measures impose a limitation on the import quantity, by way of quotas. There have been only three such investigations till date. The first safeguard quantitative restrictions investigation was initiated by the DGTR in 2019, on imports of Isopropyl Alcohol. The second investigation was on imports of PVC suspension resins with residual VCM above 2PPM in 2022. The third instance is an ongoing investigation concerning imports of Low Ash Metallurgical Coke, which was initiated in June 2023. Another interesting feature is that unlike anti-dumping and countervailing final findings, safeguard quantitative restrictions do not require approval of the MoF. The Ministry of Commerce is the approving authority for DGTR’s recommendations in such cases. It will be interesting to see if the domestic industry prefers these investigations as a more appropriate tool where protection is required for a shorter period of up to 3 years or lesser.

New Explorations: Novel versus Legacy Products: While investigations were initiated against legacy products like sulphur black, acetone, flax yarn etc., the DGTR also initiated investigations on new products such as printed circuit boards, aluminium frames for solar frames/modules, epichlorohydrin, easy open end of tin plates, telescopic channel drawers etc. Further, the DGTR also investigated imports of capital goods such as rock breakers, laser machines and wheel loaders, which marks an interesting trend.

Out of the total 38 initiations, 22 initiations concerned new products that have not been investigated before.

The above analysis showcases some patterns that might not be ordinarily visible. Such patterns can be pertinent in understanding the DGTR’s mindset. It seems that while the DGTR is keen on investigating newer products, the MoF also seems keen on selectively protecting mostly the newer products. The overall trend of the MoF rejecting majority of the DGTR’s positive recommendations continued in 2023 as well. While this is not encouraging for the domestic industry, the above analysis aids in appreciating that bringing trade remedy applications on newer products may be the way to go. While for legacy products, a very strong case on injury with minimal impact on the user industry seems desirable to succeed. Such trends are expected to set the tone for the year 2024 and beyond.

[The authors are Partner, Associate Partner and Associate, respectively, in WTO and International Trade Division in Lakshmikumaran & Sridharan Attorneys, New Delhi]