The Machinery and Electrical Equipment Safety (Omnibus Technical Regulation) Order, 2024 (‘OTR Order’) was recently extended by one year. This was a relief for foreign suppliers and Indian manufacturers alike. While extensions of Quality Control Orders (‘QCOs’) are common, the extension of the OTR Order, which is also a QCO, is important because of the scale and impact of the OTR Order.

About QCOs

The provisions of the Bureau of Indian Standards Act, 2016 (‘BIS Act’) allow the Indian Government to issue QCOs, thereby mandating that goods conform to a standard and directing compulsory use of a BIS Standard Mark. A QCO is issued when the Indian Government is of the opinion that it is necessary or expedient in the public interest or for protection of human, animal, or plant health, safety of environment, prevention of unfair trade practices, or national security.

When a QCO comes into force, the manufacturing, importing, distributing, selling, hiring, leasing, storing, or exhibiting for sale of the covered goods is prohibited without a BIS Standard Mark.

India has issued more than 185 QCOs covering over 750 products. The OTR Order stands out because of its wide horizontal coverage. Its implementation is expected to impact about 4% of total Indian imports.

Scope and coverage of the OTR Order

The OTR Order was issued by the Ministry of Heavy Industries (‘MHI’) on 28 August 2024. It originally covered 20 categories of machinery and electrical equipment and their assemblies, sub-assemblies and components mandating compliance with Indian Standards, compulsory certification, use of the BIS Standard Mark.

The OTR Order is structured in three Schedules.

i. First Schedule: Provides a list of 20 categories of machinery and electrical equipment along with relevant HSN codes.

ii. Second Schedule: Lists Type B standards, which are generic safety standards that can be used across a wide range of machinery.

iii. Third Schedule: Lists Type C standards, which are Machine Safety Standards dealing with detailed safety requirements for a particular machine or group of machines. Like the First Schedule, this Schedule also provides relevant HSN codes for each of the 20 categories along with the applicable Indian Standards.

The OTR Order further mandates that all machinery and electrical equipment covered under the First Schedule must also comply with Type A standard, namely, IS 16819: 2018 / ISO 12100: 2010. Further, apart from IS 16819: 2018 / ISO 12100: 2010, all products that are covered under the OTR Order must also conform with the applicable Indian Standard provided in the Second and Third Schedules.

The following goods are exempted from the OTR Order:

i. Goods manufactured in India and meant for export.

ii. Construction Equipment covered under Central Motor Vehicle Rules, 1989.

iii. Goods covered under any other QCO.

Amendment to the OTR Order

A major cause of worry for Indian industry and foreign suppliers was that the BIS had not started accepting applications for BIS licenses pursuant to the OTR Order. The online portal for accepting applications is yet to be launched. The online portal, as of now, only provides for pre-registration of applicants, where an applicant can provide basic details regarding its company, manufacturing locations, products manufactured, etc. Consequently, there is not even a single license holder for any of the 20 categories of machinery and electrical equipment under the OTR Order.

On 12 June 2025, the MHI issued the Machinery and Electrical Equipment Safety (Omnibus Technical Regulation) Amendment Order, 2025 (‘OTR Extension Order’). The OTR Extension Order has extended the enforcement of the OTR Order to 1 September 2026. This extension came as a much-needed breather to both the Indian industry and foreign suppliers, giving them additional time to understand and comply with the OTR Order.

Another important area of concern for the industry was the coverage of assemblies, sub-assemblies, and components, of the 20 product categories of machines and electrical equipment listed in the First Schedule of the OTR Order. The OTR Order covered not only the machines but also their assemblies, sub-assemblies, and components. However, the OTR Extension Order has now restricted its applicability to only machines and electrical equipment listed in the First Schedule. The effective date for enforcement with respect to assemblies, sub-assemblies, and components will be notified separately by the MHI.

Trade impact of OTR Order

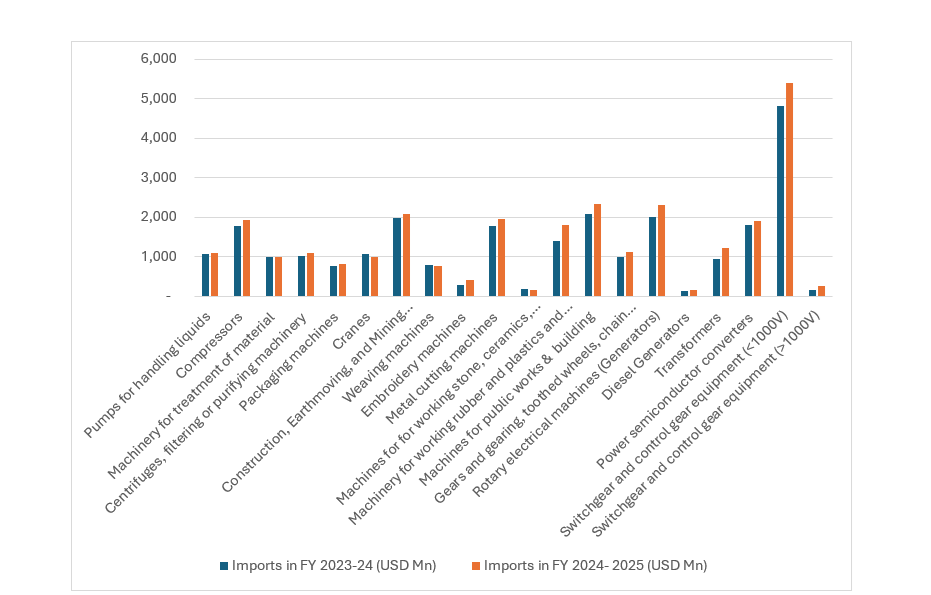

The impact of the OTR Order is expected to be substantial. An analysis of import data for HSN codes falling under the scope of the OTR Order, including both complete equipment and components, reveals that these imports into India amounted to approximately USD 28.86 billion, or about 4% of India’s total imports for the financial year (‘FY’) 2024–25. A break-up of these imports is as follows:

Source: Tradestats, Ministry of Commerce (data includes equipment and components imports)

Switchgears rated below 1000 volts accounted for the highest import value, totaling USD 5.4 billion in FY 2024-25. Other categories with high imports into India during the same period include Rotary electrical machines (USD 2.30 billion), Machines for Public Works and Buildings (USD 2.35 billion), Construction, Earthmoving and Mining Machines (USD 2.07 billion), Metal Cutting Machines (USD 1.95 billion), Compressors (USD 1.94 billion), Power semiconductors convertors (USD 1.91 billion).

For context, the Indian imports grew by 6% in the FY 2024-25 and the imports of goods covered under the OTR Order grew by 11%, nearly double the national average. This highlights the reliance of the Indian industry on imports covered under the OTR Order and thus, it was expected for the industry to have concerns about its implementation.

There are still critical gaps in understanding and implementation process of the OTR Order. These include product coverage, licensing process, and compliance mechanism. The Indian Government must plug these gaps, otherwise the uncertainty would keep on looming on the industry.

Key concerns

There are certain key areas of concern on which more deliberation is needed:

a. Complexity of Compliance: Typically, a QCO identifies the covered product and applicable Indian Standard. However, the OTR Order has three different types of standards: Type A, Type B, and Type C. Licenses under the OTR Order shall be granted under Scheme X of the BIS Conformity Assessment Regulations of 2018. It requires an applicant to identify the relevant applicable standards to their products. As a result, each applicant must now navigate the three schedules under the OTR Order and carefully identify Indian Standards which shall be applicable to their products.

b. Ambiguity in product categories: Certain product categories like Category 14 specifically cover by description both complete equipment like gearboxes and speed changes and components like toothed wheels, roller screws, etc. Although the OTR Extension Order limits the scope now to machines and electrical equipment only, it remains unclear whether the specifically listed components, such as the abovementioned are currently covered or exempted from the OTR Order.

c. Treatment of complex goods: Many of the covered machines fall into the category of complex goods, often assembled from assemblies/sub-assemblies manufactured by multiple suppliers. In many cases, the final machine is not fully assembled or tested until it reaches the customer's site in India. Such assemblies and sub-assemblies may be shipped together, giving them the character of a complete machine. In such cases, the BIS or MHI need to clarify how these assemblies and sub-assemblies need to be treated under the OTR Order, and if these are machines, who should be considered as the manufacturer, and how machines assembled on-site at an Indian customers’ premises will be treated under the OTR Order. Without such clarity, compliance will remain uncertain.

d. Lack of clarity regarding the application process: The BIS is yet to notify the operational mechanism and detailed application process under the OTR Order. The online portal for submitting applications is also yet to be launched. The lack of procedural clarity has left applicants in a flux and has delayed their license applications. As per available information, more than 650 Indian manufacturers and over 1200 foreign manufacturers have completed pre-registration for the OTR Order. This shows a strong interest amongst stakeholders to comply with the OTR Order. If the license process is not initiated timely, there would be significant bottlenecks for the applicants in the foreseeable future.

e. Wide coverage and impact on MSMEs: According to some industry estimates, the OTR Order would impact over 50,000 types of machinery and electrical equipment produced by more than 150,000 manufacturers. Most of these manufacturers are MSMEs, who will now have to navigate the complex labyrinth of the OTR Order to ensure compliance. For these MSMEs, the OTR Order introduces substantial challenges including increased compliance burden, complex licensing process, and cost.

How will OTR be implemented?

The implementation of the OTR Order is expected to be a mammoth task, not just for the Indian industry and foreign suppliers, but also for the MHI and the BIS. It is understood that the BIS has been working towards preparing SOPs, FAQs, and operational mechanisms to facilitate the implementation process. These guidance documents may be issued soon. One such guideline on the application process was issued by the BIS on 11 July 2025.

Considering the complexity of the OTR Order and the need for collaborating with the industry stakeholders, the MHI has made 7 Sector-specific Sub-Committees to address sectoral concerns and facilitate focused implementation of the OTR.

Each subcommittee includes members from the MHI, BIS and industry associations. To ensure that concerns of all types of industries are addressed, each subcommittee also has members from large, medium, and small-scale industries. They are as follows:

i. Subcommittee on Process Plant Machinery: For equipment like pressure vessels, heat exchangers, reactors, storage tanks, etc.

ii. Subcommittee on Earthmoving and Construction Machinery: For equipment like Earthmovers, cranes, compactors, pavers, loaders, graders. etc.

iii. Subcommittee on Printing. Packaging and Allied Machinery: For equipment like offset, flexographic, digital printers, cutters, labeling, and packing systems, and Packaging, processing, dosing, and sealing machines for food and pharma.

iv. Subcommittee on Textile Machinery and Machine Tools: For equipment like spinning, weaving, knitting, dyeing, finishing, and embroidery machinery, CNC, turning, drilling, milling, EDM, laser cutting machines.

v. Subcommittee on Plastic Machinery: For equipment like extruders, injection molding machines, blow molders, etc.

vi. Subcommittee on Electrical and Electronic Equipment: For equipment like motors, circuit breakers, switchgear, drives, industrial control panels, etc.

vii. Subcommittee on Automobile and Automotive Components: For items like automotive components, subsystems, and assemblies under OTR

These sub-committees would support implementation of the OTR Order by:

i. Reviewing the Indian Standards and recommending any necessary clarifications

ii. Identifying sector-specific implementation challenges

iii. Recommending sector-specific FAQs, user manuals, and awareness tools

iv. Suggesting training needs for stakeholders and enforcement agencies

Compliance with OTR Order: What should companies do?

Considering the complexity of the OTR, companies must take the following steps:

i. Identify: Companies must first identify if the products being manufactured, imported or domestically procured by them are covered under the OTR Order.

ii. Engage: Companies must engage with the BIS and MHI to resolve any issues on compliance with the OTR Order. This could include getting clarifications on the product coverage and ensuring that any sector specific FAQ issued by the BIS also answers their questions.

iii. Initiate Licensing Process: The licensing process under the OTR Order is complex. It requires submitting detailed documentation starting from identifying applicable Indian Standards to submitting all product drawings, manufacturing process, test reports, product inspection and test plan, and details of testing facilities. Considering that there would be thousands of manufacturers who are expected to apply for the license, the companies should ensure that their applications are submitted as soon as the application process is streamlined by the BIS.

[The authors are Partner, Principal Associate and Associate, respectively, in BIS practice at Lakshmikumaran & Sridharan Attorneys]