Introduction

The past few decades have seen India’s economic landscape evolving from a developing economy towards a developed economy. The evolution has been driven by multiple factors including the shift in the dynamics of international trade.

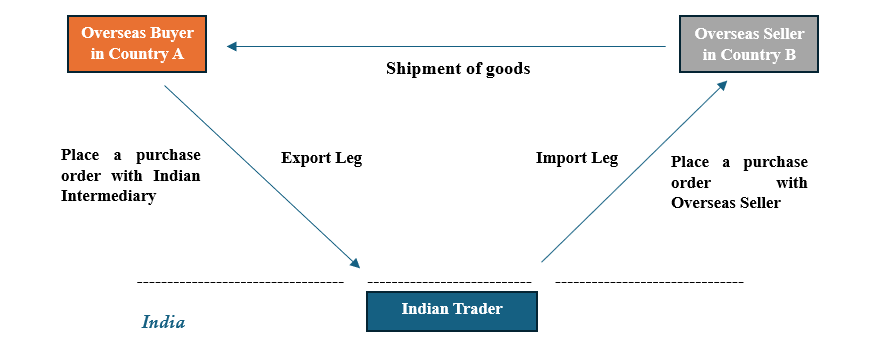

With the increase in global trade and financial activities, there has been a significant rise in cross-border trade transactions which, inter alia, includes a Merchanting Trade Transaction (‘MTT’). In simple terms, MTT is a trade transaction involving the shipment of goods from a foreign supplier/seller to another foreign buyer without entering the domestic frontiers of the trader who controls the entire trade. MTT transactions bridge the geographical gap and harmonizes trade relations across multiple customs and financial territories.

Traders undertake MTT to profit from market price variations across territories. They leverage differences in supply, demand, currency exchange rates, or taxes to buy low in one country and sell high in another. Additionally, traders engage in MTTs to earn commissions from the trades they facilitate. Essentially, an MTT bridges gaps between unknown sellers and buyers where the intermediary acts as a trusted party, ensuring smooth transactions when sellers prefer not to deal directly with unknown buyers in other countries and also to evade any trade sanctions.

A typical MTT can be understood with the help of the following example.

A trader based in India receives a purchase order from an overseas buyer in Country A and the same trader places a back-to-back order with an overseas seller/supplier based in Country B for direct delivery of the goods to the overseas buyer in Country A. Such a trade where the goods do not enter the Domestic Tariff Area (‘DTA’) of India (i.e., without crossing the customs borders of India), is regarded as an MTT.

Here, the entire transaction can be divided into two legs:

1.Import Leg: Amount payable to the Overseas Seller in Country B

The Indian trader, who receives a purchase order from the Overseas Buyer in Country A, will place a back-to-back purchase order on the Overseas Seller located in Country B and shall make a payment for the purchase of such goods. Here, the Overseas Seller will be specially instructed to deliver the goods to the Trader’s Overseas Buyer located in Country A, while bill the sale price to the Indian trader.

2. Export Leg: Payment receivable from the Overseas Buyer in Country A

The Indian trader shall receive the payment for the goods from the Overseas Buyer located in Country A and the goods shall be delivered to the Overseas Buyer by the Overseas Seller directly, without the goods physically entering India.

The Indian trader’s / intermediary’s profit arises from the difference between the export proceeds and the import payments.

The relevant legislation

In order to regulate and facilitate Merchanting Trade Transactions, RBI vide its notification dated 23 January 2020 framed the MTT – Revised Guidelines (‘MTT Guidelines’) in supersession of the erstwhile guidelines [contained in A.P. (DIR Series) Circular No.115 dated March 28, 2014]. The same amendments have been incorporated in the Master Direction – Import of Goods and Services (‘MD-Import’).

Conditions for MTT

It is pertinent to sieve transactions through the strain of the following filters, to be considered as an MTT:

The goods should not physically enter the DTA;

The transaction must be profitable; and

The concerned goods are not prohibited from being traded under the Foreign Trade Policy, 2023 (‘FTP’).

In furtherance to the above, the MTT guidelines and MD-Import provides for the following conditions which an MTT shall be subject to:

1. Compliance requirements for both import (except bill of entry) and export legs (except export declaration form) must be adhered to separately;

2. Entire transaction shall be routed through the same AD Bank and completed within 9 (nine) months;

3. Outlay period between the inward and outward remittance shall not exceed 4 (four) months;

4. Third-party payments are not permitted; and

5. Agency commission (except in prescribed exceptional cases) is not allowed.

Payment for the import leg

Payment for the import leg can be made by merchant traders from their Exchange Earners Foreign Currency (‘EEFC’) account balances. Advance payment for MTT transactions is permitted in the event of demand from the overseas supplier. If inward remittance (for the export leg) isn't received prior to the outward remittance (for the import leg), the AD Banks can handle such transactions basis their commercial judgement. Letter of Credit to supplier is allowed against confirmed export orders, with foreign exchange outlay of four months and MTT completion within nine months and compliance with other prescribed conditions.

Payment for the export leg

If any payment pertaining to export is received prior to payment being remitted against the import leg, such amount can be held in an interest-bearing INR account or an EEFC account until the import leg liability is incurred. This money must be specifically set aside or lien-marked for the payment of import leg, and any import leg liability must be promptly satisfied out of these funds as soon as it materializes.

Proposed changes to the trade regulations in India

The RBI issued a Statement on Developmental and Regulatory Policies on 7 June 2024 pursuant to which the RBI issued the draft Foreign Exchange Management (Export and Import of Goods and Services) Regulations, 2024 and draft Directions to Authorised Dealers on Export and Import of Goods and Services on July 2, 2024 (hereinafter collectively referred as the ‘Draft Regulations and Directions’).

The major changes in relation to MTT are summarized below:

1. the Draft Regulations and Directions do not specify any timeline for completion of the MTT transaction;

2. as per the proposed changes, the Draft Regulations and Directions do not address the existing mandatory provision for the MTT transactions to be profitable;

3. the Draft Regulations and Directions are also silent on the permissibility or prohibition of agency commission; and

4. the outlay period between the outward and inward remittance of the MTT has been extended to 6 (six) months.

It is also to be noted that an amendment had been made in the FTP, whereby transactions involving shipment of goods within one specific foreign country without physically entering India shall also be considered MTT. However, no corresponding amendment or clarity has been provided in the MD-Import. Even the Draft Regulations and Directions fail to provide clarity on the treatment of such transactions, leaving stakeholders uncertain about compliance requirements.

Conclusion

Under the existing legislation, MTT is bound by multiple stringent conditions. However, the Draft Regulations and Directions introduces a plethora of ambiguities by omitting certain key provisions.

Notably, the proposed legislation does not address the timeline for completion of MTTs or the profitability of such transactions. While it can be interpreted that the elimination of the conditions of ‘profitable transaction’ and the ‘nine months’ timeline burden will give more flexibility to traders and encourage them to explore and engage in MTT without the burden of ensuring profitability, the lack of a specified timeline might also raise ambiguity and a practical challenge as to how these transactions will be managed. The existing legislation prohibits payment of agency commission except in certain conditions, however, the Draft Regulations and Directions have omitted such prohibition. While such an omission might make MTT an attractive mode of cross border trade, it is yet to be observed whether any remittance towards such agency commissions will be permitted specifically in the event the MTT is not a profitable one.

An increase in the payment outlay period to six months will give increased flexibility to traders and allow them time to ensure liquidity flexibility, better risk management etc. It is anticipated that with the implementation of the above, the regulatory compliances will decrease which shall boost India’s trade transactions, reduce the compliance cost pertaining to such transactions, and consequently fuel India’s growing economy. However, such omissions could result in broader interpretations, increased ambiguity, and potentially more loopholes for offenses to exploit.

The RBI has called for public feedback on the Draft Regulations and Directions via email by 1 September 2024. It is crucial for industry participants and trade associations to submit relevant representations and seek clarification on unresolved trade issues.

[The authors are Partner and Associate, respectively, in Corporate and M&A practice at Lakshmikumaran & Sridharan Attorneys]