Recently in the Union Budget for the financial year 2025-26 the Hon’ble Finance Minister emphasized the government's commitment towards improving the ease of doing business in India. The Minister announced that the requirements and procedures for speedy approval of company mergers will be rationalised. Additionally, the scope for fast-track mergers will also be widened and the process made simpler. This initiative aims to provide a more transparent, quicker, and hassle-free framework for corporate restructuring.

The Ministry of Corporate Affairs (‘MCA’), with the objective of promoting ease of doing business in India, had introduced the concept of fast track merger or amalgamation (‘FTM’) in 2016 under Section 233 of the Companies Act, 2013 (‘Act’) read with Rule 25 of the Companies (Compromises, Arrangements and Amalgamations) Rules, 2016 (‘CAA Rules’), effective from 15 December 2016, empowering the Regional Directors to approve or reject the scheme of FTM.

FTM is an alternate process to the traditional process of scheme of merger or amalgamation provided under Sections 230 to 232 of the Act. Unlike the procedure under Sections 230 to 232 of the Act, FTM involves less legal requirements, and is simpler, less time consuming and cost efficient. The major advantage under the FTM process is that intervention of the National Company Law Tribunal (‘NCLT’) is not required here.

Section 233 of the Act read with CAA Rules allows scheme of FTM between: (i) two or more small companies; (ii) a holding company and its wholly owned subsidiary (‘WOS’); (iii) two or more start-up companies; and (iv) between one or more start-up companies with one or more small companies.

Considering the intent of the announcement made in the Union Budget, the MCA has proposed to widen the scope of companies under Section 233 of the Act read with Rule 25 of CAA Rules vide Companies (Compromises, Arrangements and Amalgamation) Amendment Rules, 2025 (‘Amendment’), vide public notice dated 4 April 2025. The extended category of companies allowed under FTM are as follows:

Category I : Unlisted companies (except Section 8 company) merging with one or more unlisted companies (except Section 8 company) subject to certain conditions that the companies involved in the scheme of FTM should not have: (i) a borrowing of INR 50 crores or more from banks or financial institutions or any other body corporate; and (ii) defaulted in repayment of such borrowings, at least 30 days before issuing the notice of merger to the ROC and OL inviting their objections, if any, under Section 233(1)(a) of the Act.

Our analysis:

1. Under this category, all unlisted companies, including private and public, are permitted to apply for FTM subject to the two conditions that both the transferor and the transferee companies should not have:

(i) borrowings (borrowed from any person) of INR 50 crores or more; AND

(ii) no track of default in repayment of such borrowings, at least 30 days before issuing the notice of merger to the ROC and OL inviting their objections, if any, under Section 233(1)(a) of the Act.

2. The companies proposing to undertake FTM under this category are required to furnish a certificate obtained from their auditor certifying that the company meets the borrowing requirements prescribed therein.

3. Exclusion of Section 8 companies under this category would be a drawback of this Amendment which disallow FTM of Section 8 company with a company which is neither its holding company nor a subsidiary company.

Category II: A holding company (listed or unlisted) merging with its one or more unlisted subsidiary company or companies;

Our analysis:

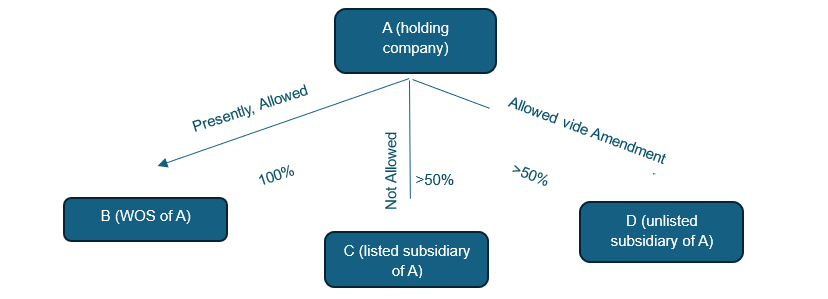

1. Presently, under the Act and CAA Rules, a FTM between a WOS with its holding company is allowed.

2. In the proposed Amendment, the ambit of Section 233 of the Act has been extended to cover FTM of one or more subsidiary company or companies with its holding company, wherein the holding company under FTM can be listed or unlisted however, the subsidiaries should be unlisted company.

3. Even under the Amendment, if under a scheme of FTM, the subsidiary is the transferor and listed on a stock exchange, such schemes are not permitted under the ambit of Section 233 of the Act.

Category III: One or more subsidiary company of a holding company with one or more other subsidiary company of the same holding company where the transferor company or companies are not listed.

Our analysis:

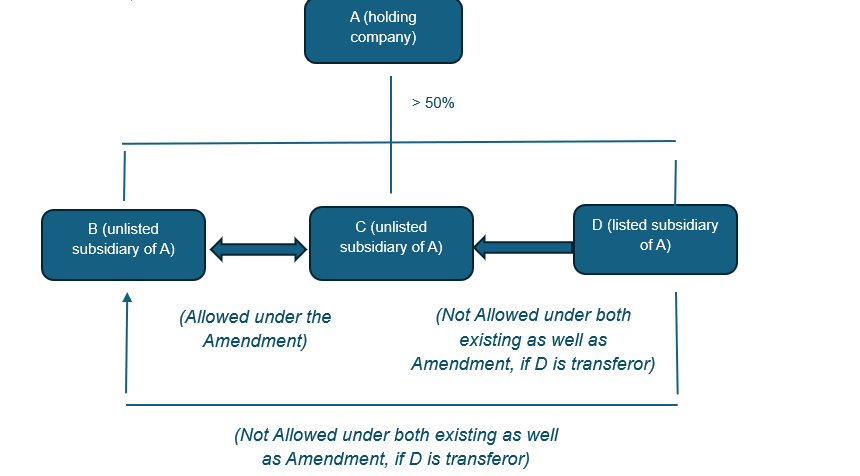

1. Presently, a FTM between holding company and WOS are permitted. Also, as noted in Category II above, a FTM between holding company and its unlisted subsidiaries are proposed to be permitted.

2. Further, under this category, it has been proposed to allow FTM among one or more subsidiaries of the same holding company, subject to a condition that the transferor company should not be listed on any stock exchange.

3. In above diagram, a FTM between B and C are allowed however, a FTM between B and D or C, and D are not allowed, if D is a transferor company and listed on any stock exchange under the scheme.

Category IV: Merger of the transferor foreign company incorporated outside India being a holding company with the Indian transferee company being the wholly owned subsidiary of the foreign company as referred to in sub-rule (5) of Rule 25A of CAA Rules.

Our analysis:

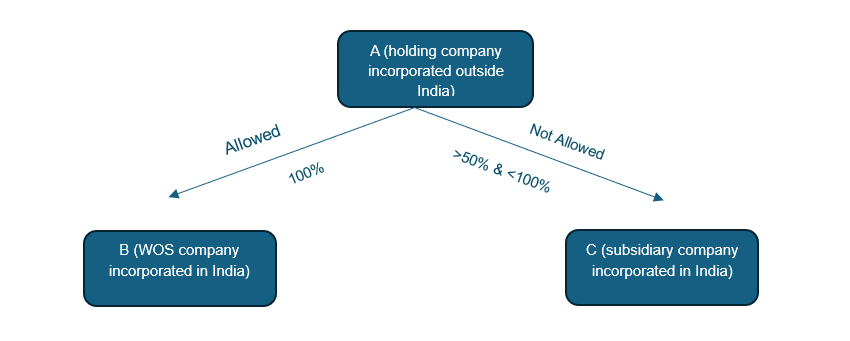

1. Under this category, FTM of a holding company incorporated outside India with its WOS incorporated in India is allowed.

2. At present, the MCA, by its notification dated 9 September 2024 (effective from 17 September 2024), has allowed reverse merger or amalgamation under Section 233 of the Act read with Rule 25A of CAA Rules vide Companies (Compromises, Arrangements and Amalgamations) Amendment Rules, 2024 (‘2024 Amendment’) providing reference to Section 233 of the Act prescribing the Indian transferee company to obtain approvals in accordance with FTM process. The proposed Amendment is to bridge a gap among Section 233 of the Act, Rules 25 and 25A of the CAA Rules.

Our views:

The Amendment seeks to cover more categories of companies under FTM process, however, the following mergers and amalgamations under the FTM process are not allowed:

(i) Section 8 company is not allowed to undergo FTM, unless Section 8 company is undergoing FTM with its holding company or WOS or subsidiary company.

(ii) Under each category discussed above, if the subsidiary company is a transferor and listed on a stock exchange under a scheme of FTM, such scheme of FTMs are not permitted.

(iii) The provisions of the Act and the Amendment permits reverse mergers i.e., a foreign holding company undergoing FTM with its Indian WOS. However, FTM of Indian WOS with its foreign holding company is not permitted under Section 233 of the Act read with CAA Rules and the Amendment.

(iv) Under Category IV discussed above, the Indian transferee company should be a WOS. However, if the Indian transferee company is only a subsidiary of the foreign holding company, FTM is not allowed.

[The authors are Senior Associate and Consultant, respectively, in Corporate and M&A Team at Lakshmikumaran & Sridharan Attorneys, Hyderabad]